From: John Conover <john@email.johncon.com>

Subject: Re: Exposing my ignorance

Date: Thu, 6 Aug 1998 14:17:54 -0700

John Conover writes:

>

> Attached is a graph of the R/S analysis for Ascend's (ticker ASND,)

> stock value, (from 4 January, 1995 to 1 May, 1996,) with a best fit

> linear approximation. (Note that the slope of the best fit linear

> approximation is 0.500485. Exactly-to within 0.1%-what we would expect

> from a fractal constructed by a random process with independent

> increments, and a Gaussian distribution.) The graph offers very

> compelling evidence that equity prices are, indeed, fractal in nature,

> and the statistics of the fractal are constructed by a Brownian motion

> type of process. It is in pdf file format.

>

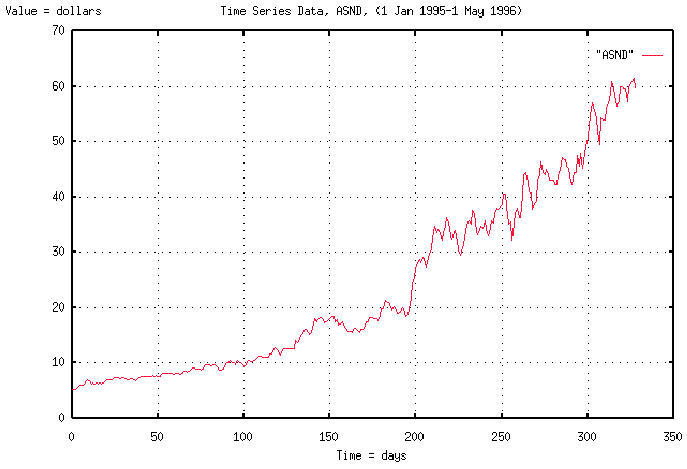

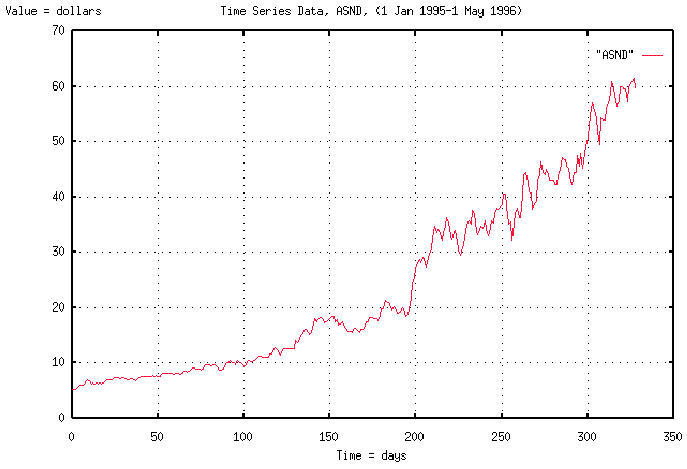

Attached is a graph of the stock value of Ascend, (ticker ASND,)

between 1 January, 1995 and 1 May, 1996, (it is a graph of the data

used in the previous rescaled range/scale analysis graph.) You will

note that this was during the big run up of Ascend's value-it was

right after it went public, and just before its big crash, (right

after this graph ends, Ascend-and most of the Internet electronics

companies-lost over 60% of their value.) That is why I choose Ascend,

and this time frame, as an example.

By looking at the attached graph of Ascend's stock value, it would

certainly seem that one should have been invested in Ascend, right? It

would intuitively seem so.

However, by looking at the previous rescaled range/scale analysis

graph, it would seem counter intuitive to be invested in Ascend.

Why? Because the rescaled range/scale analysis suggests that:

1) The past has absolutely no bearing on the future,

whatsoever. Good stock performance in the past can not be used as

an indictor of future stock performance. If one attempts to do

so, one will win 50% of the time, and loose 50% of the time, for a

net gain of nothing. The future is determined by a 50/50 lottery.

2) It is impossible to "time the market". If one attempts to "time

the market", one will succeed 50% of the time, and fail 50% of the

time, for a net gain of nothing. Again, the future is determined

by a 50/50 lottery.

3) There can never be a theory that will determine how the lottery

works-any such theory, (for example, P/E ratio correlations,) will

succeed 50% of the time, and fail 50% of the time, for a net gain

of nothing, since the future is determined by a 50/50 lottery.

John

-- John Conover, john@email.johncon.com, http://www.johncon.com/