From: John Conover <john@email.johncon.com>

Subject: Electronic Components Shipments Industrial Marketplace

Date: Wed, 14 Oct 1998 18:44:38 -0700

Although executive management is concerned with many issues, the most

significant issue in a corporation's durability is operational

strategy-which means controlling cash flow. It is a difficult

financial issue to address since cash inflow fluctuates month to

month, do to the market environment, etc. However, these fluctuations

do have general characteristics that can be used in strategic

financial planning.

To demonstrate a methodology for analyzing industrial market

fluctuations, I will derive the metrics for the electronic component

market in the United States. The data used readily available from the

US Department of Commerce, and contains the monthly shipments of

electronic components between January, 1979 and January, 1994,

inclusive. (The specific data used is labeled "MSEL367X, Electronic

Components and Accessories Shipments, by Millions of Dollars," and is

available on line from http://www.doc.gov/.)

The objective is to develop a conceptual model for the fluctuations in

industrial markets that:

1) Can be used in financial planning-specifically, we would like

to have an understanding of the duration of industrial market

expansions and contractions.

2) Should be conceptually useful-specifically, it must be

intuitive, and usable without elegant numerical

methods. Preferably, any calculations should be simple enough that

they could be done in one's head.

3) Should be capable of working with limited data-the reality is

that we do not have adequately concise data for industrial markets

in the US. Preferably, the model should be able to predict what

would be observed with such limited data.

What I will do is to state the model, and then offer a compelling and

lengthy argument as to why it is correct.

The model is that duration of the fluctuations in industrial markets

have a probability of 1 / sqrt (t). It is not complicated. What's the

probability of a "recession" lasting longer than four months? 1 / sqrt

(4) = 1 / 2 = 50%. And longer than two months? 1 / sqrt (2) = 0.707 =

71%. How about longer than seven months? 1 / sqrt (7) = 0.378 = 38%.

Note exactly what the model says-as an example, if you are two months

into a market's "recession", the chances of the "recession" continuing

two more months, or longer, is 1 in 2. The chances of it continuing 5

more months, or longer, is a little more than about 1 in 3. The same is

true for those times when the market is expanding, too. Simple as it

may be, it is astonishingly accurate.

The first and part of the second objectives have been satisfied. The

remaining question is why it works?

The reason is that industrial markets are fractal systems, and there

is a robust infrastructure in mathematics and economics that deals

with such things. However, I will approach the issue of intuitive

understanding through the construction of a single graph.

What we are discussing is the run length of industrial market

expansions and contractions. Let me propose the following prescription

for analyzing industrial market data. (You do not have to do this

analysis for other industrial markets-astonishingly, all markets have

the same contraction and expansion characteristics.) Suppose we have

market data that shows dollar shipments per month over a time period

of many years. For each month in our data, we simply count the number

of months until the market comes back to that value. That number would

be the run length of that market expansion or contraction, depending

on whether the market increased, or decreased respectively. We then

count how many of each run length we have, and make a graph of it.

Unfortunately, this is not exactly the information we want. Such a

graph would give us the likelihood that a run length's duration would

be EXACTLY 3 months, or 5 months, or whatever. For planning purposes,

we want to know the likelihood that a run length's duration would be

LONGER than 3 months, or 5 months, or whatever. We need the cumulative

sum of the run lengths, (which is a fancy statement that means we

simply want to add them up, and make a new graph.)

Although such data "munching" can be done on a spread sheet, there are

programs available that will do the same thing very expediently. (The

program I used for the generation of the attached graph was

tsrunlength, and available at

http://www.johncon.com/ndustrix/archive/fractal.tar.gz, and produced the data

for the attached graph in just a few seconds. The program is Open

Source, ie., free.)

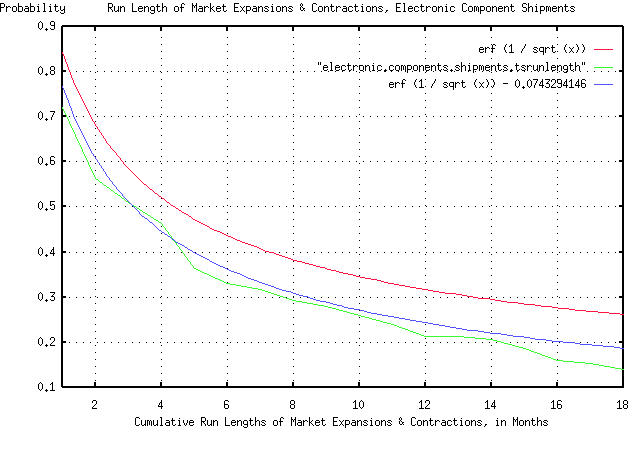

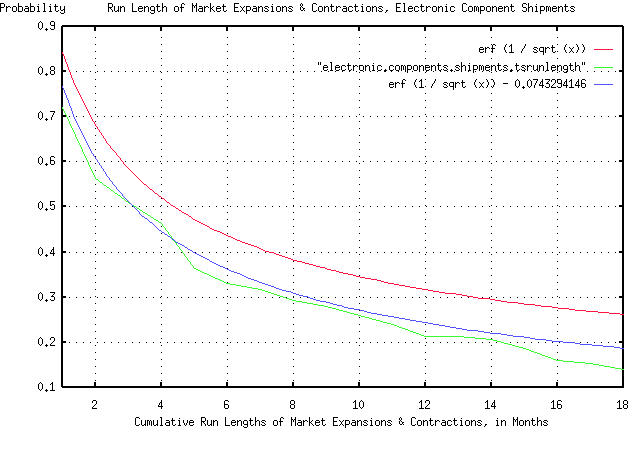

The formula listed above, 1 / sqrt (t), is not precisely true. It

actually has an error function in it-the precise, theoretical form is

erf (1 / sqrt (t)). In the attached graph, I used the formal version

to demonstrate the accuracies. The error function has virtually no

significance for t much greater than 1.

I now have to address the issue of limited data set size-there were

181 "points" in the data for electronic component shipments in the

data from the Department of Commerce. If you think about it, finding a

run length of longer than 181 months in the data for 181 months is

impossible. But I know, that given a much larger data set size, I

would find some. What's the chances of that happening? About 1 / sqrt

(181) = 0.0743 = 7.4%. So, I can now compensate my theoretical form,

erf (1 / sqrt (t)), to make it look like my empirical data from the

Department of Commerce. I just subtract 0.0743 from it to compensate

for the limited data set size-and our third objective is complete.

We have one remaining issue. And that is how intuitive is it? The

graph is compelling:

All the graph means is that if you want to find the chances of the

duration of an industrial market expansion or contraction being longer

than, say four months, you find 4 on the x axis, move up to the graph,

and left to the y axis, and read about 0.5 = 50%. There are three

graphs displayed. The "real" graph is erf (1 / sqrt (t)), and is the

graph that should be used. The graph erf (1 / sqrt (t)) - 0.0743294146

is what we would expect to see if our data set was 181 months, and the

remaining graph is the empirical data from the Department of Commerce,

which consisted of 181 months. All in all, a respectable "fit" of

empirical data to our theoretical model.

There is one remaining question. What happens if we want to know the

characteristics of the duration of the run lengths of market

expansions and contractions in years, instead of months?

Astonishingly, it doesn't make any difference! The same rule holds

irregardless of the time scale-for which, I will offer compelling

evidence.

John

--

John Conover, john@email.johncon.com, http://www.johncon.com/