From: John Conover <john@email.johncon.com>

Subject: Cute graph of the DJIA

Date: 4 Feb 1999 10:00:58 -0000

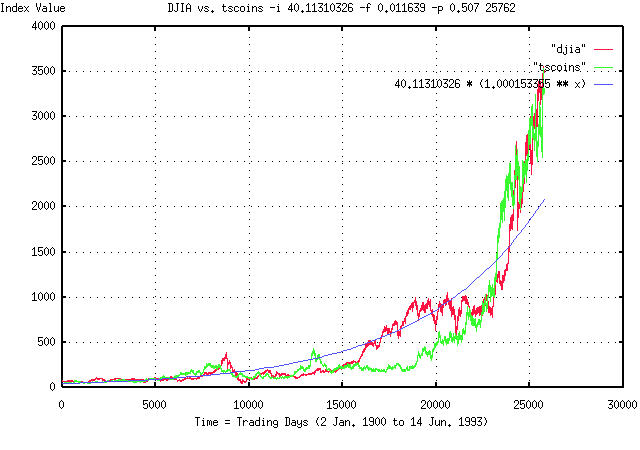

I was doing some simulation work on the statistics of the Dow Jones

Industrial Average this morning and was using the tscoins(1) program

as the simulator. The tscoins program does not mimic the DJIA-it

generates a graph with the same statistics, (why one would want to do

that is a long story for another time,) using a random number

generator.

Attached is a graph of the DJIA, (2 Jan. 1900 to 14 Jun. 1993, by the

trading day,) the graph generated by the tscoins program, and an

exponential graph.

If one measures the statistics of the DJIA, they are as follows:

The average, avg, of the marginal daily returns is 0.000221.

The root mean square, rms, of the marginal daily returns is

0.011639.

This means that the likelihood of an up movement, P, is:

P = ((avg / rms) + 1) / 2 = 0.509497

These three numbers determine the statistics-all growth, volatility,

etc., is determined by these numbers.

The tscoins program is very simple internally-it generates a Gaussian

random number, adds it to a running sum, generates another random

number, and its it to the sum, and so on, (ie., it is a random walk

fractal generator.) The command line for the tscoins program was:

tscoins -i 40.11310326 -f 0.011639 -p 0.509497 25762 > tscoins

since there were 25762 trading days between 2 Jan. 1900 and 14

Jun. 1993. (The fractal model is a compound interest sort of thing,

ie., 1.00015^25762, and very small numerical inaccuracies can create

visible disparities after 25762 days-the actual number used in the

graph was -p 0.507, about a half of a percent less than the measured

value. All I did was to use the theoretical value, and decrease it so

that the graphs ended at the same value.)

The exponential graph is the expected gain, if averaged over infinite

time from the daily returns, R. R can be found from the formula:

R = ((1 + rms)^(P)) * ((1 - rms)^(1 - P))

= ((1 + 0.011639)^(0.509497)) * ((1 - 0.011639)^(1 - 0.509497))

= 1.000153355

and the exponential graph formula is 40.1131326 * (1.000153355)^t

where t is time, in trading days.

The exponential graph is what one would expect as returns from the

DJIA, after all the stochastic stuff had been smoothed out. The graph

produced by tscoins has the same stochastic statistics as the DJIA.

All three graphs are superimposed for comparison.

What is so interesting about this? If you look at the DJIA and tscoins

graph, they just look statistically similar, and both deviate from the

exponential graph in about the same way, (but, obviously, not at the

same places.)

For example, look at the DJIA at about 8000 days, (this down trend was

the 1929-1931 "crash".) Compare this to the "crash" at about 13000 in

the tscoins graph. Look at the big run up in both graphs starting at

about 23000 days. (That such things happen near each other is quite by

serendipity-the tscoins graph was generated with random

numbers. Usually, the graphs don't look so close, even though they are

statistically similar.)

The point is that the departures from the exponential graph in both

the DJIA and tscoins graphs is quite large, with much the same shape,

(although not at the same place, which is, obviously, what one would

expect.) Note that a factor of 2X, or more, from where they are

"supposed to be" is the norm, and not the exception in both graphs.

John

BTW, here is the measured statistics of the tscoins graph:

The average, avg, of the marginal daily returns is 0.000238.

The root mean square, rms, of the marginal daily returns is

0.011570.

This means that the likelihood of an up movement, P, is:

P = ((avg / rms) + 1) / 2 = 0.510285220

And R would be 1.000171088.

One can kind of comprehend the problem in numerical analysis of

fractals. They deviate so far from "average" that huge data sets are

required to get the "average". A century, by the day, was only

marginally enough data.

Look at what would have happened if one made measurements of the DJIA

at 5000 through 8000 days, or at 23000 through 25000 days-about a

decade each, of very inappropriate, misleading, and non-representative

data. (This is how fortunes have been lost in the equity markets using

quantitative analysis.)

FYI, as a least squares exponential fit to the DJIA graph:

e^(3.694195 + 0.000145t) = 1.000145^(25461.866810 + t)

= 2^(5.329597 + 0.000209t)

(the starting value in the exponential and tscoins graph was

1.000145^25461.866810 = 40.11310326,) and the tscoins graph:

e^(3.699252 + 0.000132t) = 1.000132^(27995.179290 + t)

= 2^(5.336892 + 0.000191t)

-- John Conover, john@email.johncon.com, http://www.johncon.com/