From: John Conover <john@email.johncon.com>

Subject: What does the phrase "likelihood of an up movement" for a stock mean?

Date: 28 Aug 1999 05:59:16 -0000

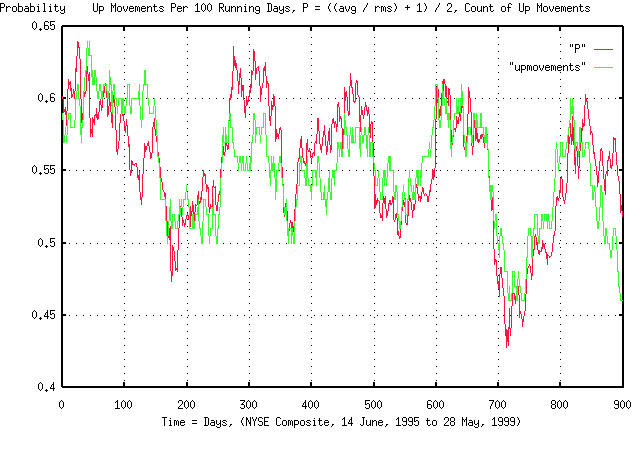

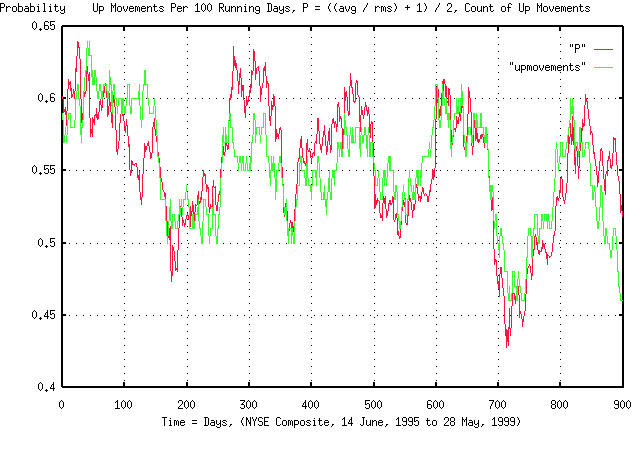

Someone ask the relationship between the Shannon Probability and the

likelihood of an up movement in the value of a stock. The Shannon

Probability, P, is calculated by finding the average, avg, and the

root mean square, rms, of the marginal increments in the value of a

stock:

avg

--- + 1

rms

P = -------

2

where the t'th marginal increment at time t is:

V - V

t t - 1

-----------

V

t - 1

ie., today's marginal increment in the value of a stock is today's

value, minus yesterday's, divided by yesterday's.

Exactly why the ratio of the average and root mean square of the

marginal increments, over time, give the likelihood of an up movement

in the value of a stock is not a trivial question to answer-and there

is a discussion of such things on the Ntropix FAQ's web page at:

http://www.johncon.com/ntropix/FAQs.html

which are fragments and excerpts from the tsinvest program sources and

documentation, available at:

http://www.johncon.com/ntropix/

However, it is very easy to verify-just count the number of up

movements in a stock's value in a time period, and compare it to the

Shannon probability, P, measured and calculated over the same time

period.

The attached is a graph of the comparison over the last one thousand

days of the NYSE Composite Index.

John

BTW, the way the graph was made using the tsshannonwindow program,

(from http://www.johncon.com/ntropix/utilities.html,) with -a

-e -w 100 arguments for a running window of 100 days. Note that there

are issues with just counting the up movements. How are days where

there is no movement in value handled, (ie., count it as an up

movement, or a down movement, neither, or both?) And, there is no

tally of how large an up movement is, just that it moved

up. Nevertheless, the graph shows that the Shannon probability and the

likelihood of an up movement are the same, and counting up movements

over an interval is a intuitive heuristic approach to quantifying

stock value performance.

-- John Conover, john@email.johncon.com, http://www.johncon.com/