From: John Conover <john@email.johncon.com>

Subject: Persistence in the US equity market indices

Date: 28 Aug 1999 07:19:58 -0000

What persistence in the equity markets means is that there is more

than a 50/50 chance that an equity value is doing today what it did in

the past.

Unfortunately, the probability of persistence is usually not linear,

and very difficult to measure. The metric of persistence is kurtosis,

(or, more correctly, leptokurtosis.) What leptokurtosis means is that

the fractal that represents the value of a stock has a bell shaped

frequency distribution of the marginal returns, but it is not a normal

(or Gaussian,) bell curve-it is squished in at the sides, and the

tails are too high. For an example, see:

http://www.johncon.com/john/correspondence/981230002304.31518.html

The traditional methodology of analyzing leptokurtosis has been Hurst

Exponents-a methodology that has been used for about a half a century,

with reasonable success.

Unfortunately, there are issues with Hurst's methods-it is inaccurate

for very short time intervals, (ie., measuring today to predict what

is going to happen tomorrow,) and it is computationally inefficient

for accuracies necessary in programmed trading. It is also quite

sensitive to large "correctional" transients, and does not predict

well for persistences larger than about 60%. Not that any of these in

any way degrade Hurst's contributions-Hurst's methods stand as a

classic and created a paradigm shift in the quantitative analysis of

financial markets that is still being explored today.

The tsinvest program circumvents many of the problems associated with

Hurst's methods by directly constructing a frequency distribution of

like consecutive movements in equity values. If the fractal being

measured has a Brownian motion characteristic, the cumulative

frequency distribution would be 0.5, 0.25, 0.125, ... However, if

there is, say, a 60% persistence, the distribution would be 0.6, 0.36,

0.216, ...

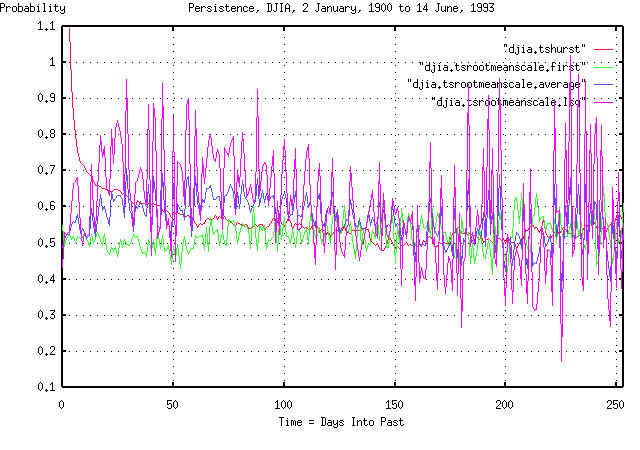

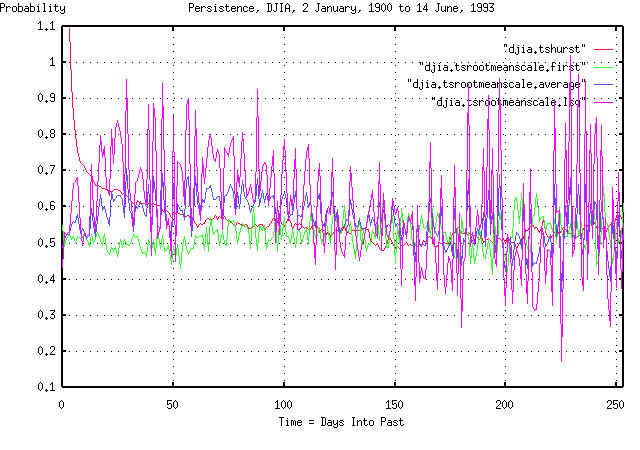

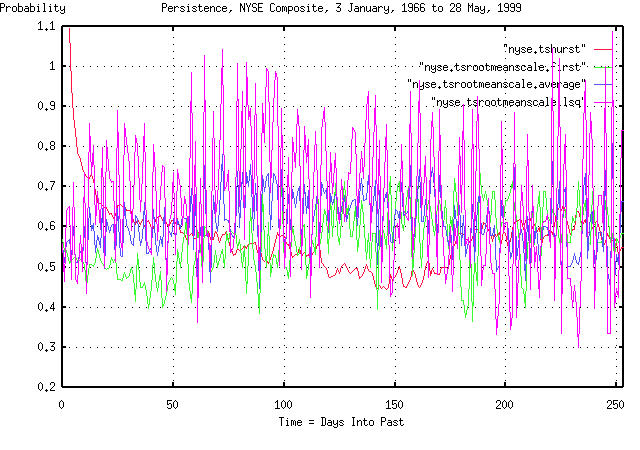

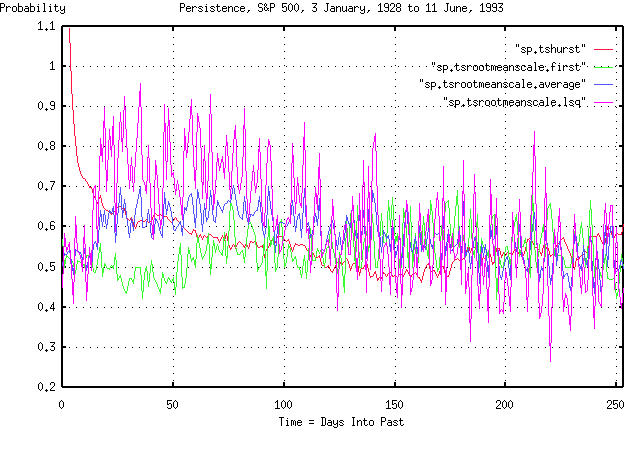

Attached are three graphs that compare the method used in the tsinvest

program and Hurst's method. They are for the daily closes for the DJIA

from 1900 to 1993, the NYSE Composite, from 1966 to the present, and,

the S&P 500, from 1928 to 1993.

Note the discrepancy between the two methods at short time intervals,

less than 50 days, or so. Also, note that the broad market index,

(NYSE,) has no leptokurtosis at about 120 days-but both the DJIA and

the S&P 500 do. (What this means is that the DJIA and the S&P 500,

have about a 60% chance of doing today what they did about 120 days

ago.) Note, also, that the method used in tsinvest correctly

identifies a very short term persistence, of less than a very few

days, (this continues on into inter-day trading, too; its frequently

exploited by day traders.)

The attached three graphs contain an overlay of three graphs: the

Hurst Coefficient; and from tsinvest, the first element in the

frequency distribution of like consecutive movements; and the least

squares best fit of the frequency distribution.

John

--

John Conover, john@email.johncon.com, http://www.johncon.com/