From: John Conover <john@email.johncon.com>

Subject: logistic non-linear extensions used in tsinvest

Date: 10 Nov 1999 05:32:13 -0000

On the home page of the tsinvest program, http://www.johncon.com/ntropix/,

concerning the tsinvest and tsinvestsim programs, it is mentioned:

"The programs use non-linear extensions to the random walk fractal

model of equity prices. The extensions are similar to the discreet

time "logistic" (parabolic) function. A derivation of the model is

contained in the tsinvest

documentation."

To elaborate on the non-linear extensions, the program tsinvestsim was

used to generate a time series for the tsinvest program using the data

file "tsinvest/tests/optimal.equal.data" from the tsinvest regression

test suite in the source tree, (which represents "typical" data for

stocks on the US equity markets.)

The -j option was used on tsinvest, (which means to use the

non-default method of computing the index of all stocks in the

simulation-similar to the method the equity exchanges use to calculate

the broad market indices,) and the index of the 300 stocks, (all

identical, with a Shannon probability, P, ie., a likelihood of an

increase, of 0.51, optimal growth, ie., a root mean square of the

marginal returns of 0.02,) specified in the data file analyzed. The

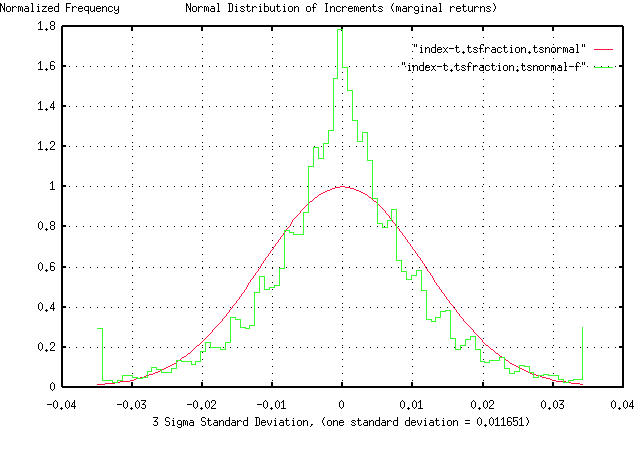

frequency distribution of the marginal returns for the simulated index

is:

and agrees favorably with the frequency distribution of the marginal

returns for the indices of the US equity markets presented at:

http://www.johncon.com/john/correspondence/981229233103.31169.html

Of interest is the kurtosis in both graphs. (Note that in the

simulation, the kurtosis was not the result of persistence, ie., a

Hurst exponent greater than 0.5-it is the result of the non-linearity

of the algorithm used by tsinvestsim, which used a random number

generator, with independent increments, to make the index's increments

a binomial distribution as an approximation to a Gaussian/normal

distribution.)

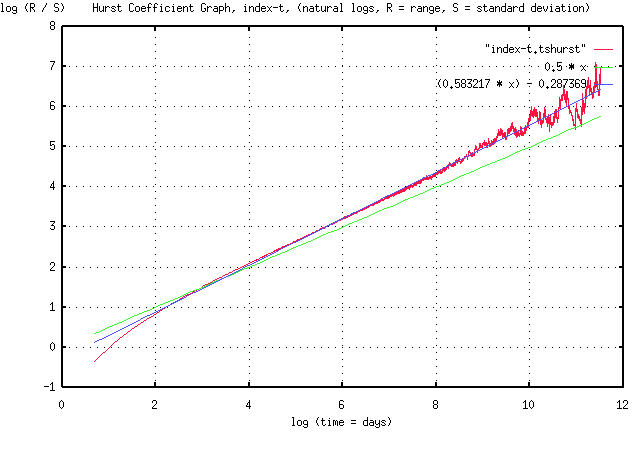

The Hurst exponent for the simulated index is:

and, also agrees favorably with the Hurst exponent for the NYSE

Composite index presented at:

http://www.johncon.com/john/correspondence/980807151309.11811.html

Likewise, of interest is that the Hurst exponent is greater than

0.5. (Note that in the simulation, the Hurst exponent was not the

result of persistence, it is the result of the non-linearity of the

algorithm used by tsinvestsim, which used a random number generator,

with independent increments, to make the index's increments a binomial

distribution as an approximation to a Gaussian/normal distribution.)

John

--

John Conover, john@email.johncon.com, http://www.johncon.com/