|

From: John Conover <john@email.johncon.com>

Subject: Quantitative Analysis of Non-Linear High Entropy Economic Systems VII

Date: 28 Aug 2006 09:39:47 -0000

As mentioned in Section I, Section II, Section III, Section IV, Section V and Section VI, much of applied economics has to address non-linear high entropy systems-those systems characterized by random fluctuations over time-such as net wealth, equity prices, gross domestic product, industrial markets, etc.

A quick review of this series.

Many economic systems are characterized by non-linear high entropy time series. These time series are a geometric progression, as analyzed in Section I, and the distribution of the marginal increments of the time series exhibit log-normal distributions, as suggested in Section II. The characteristics of the marginal increments can be analyzed as suggested in Section III, and, Section IV, to formulate investment strategies and optimizations as illustrated in Section V. The finer details of the types of leptokurtosis found in the marginal increments of financial time series is analyzed in Section VI.

Revisiting the DJIA, (since it has a long historical database,) a meticulous analytical approach will be used to analyze the characteristics of the closing values of the DJIA. The analytical procedure will use a conscientious process commonly used in engineering practice:

script

of analytical

programs, "chained" together, (usually with Unix

pipes for maintainability and extensibility.)Note: the C source code to all programs used in the

script

are available from the NtropiX Utilities

page, or, the NdustriX Utilities

page, and is distributed under License.

The historical time series of the DJIA index was obtained from Yahoo!'s database of equity Historical Prices, (ticker

symbols ^DJI,) in csv format. The csv

format was converted to a Unix database,

djia, using the csv2tsinvest

program. (The DJIA time series started on January 2, 1900, and

contained 29010 daily closes, through May 26, 2006.)

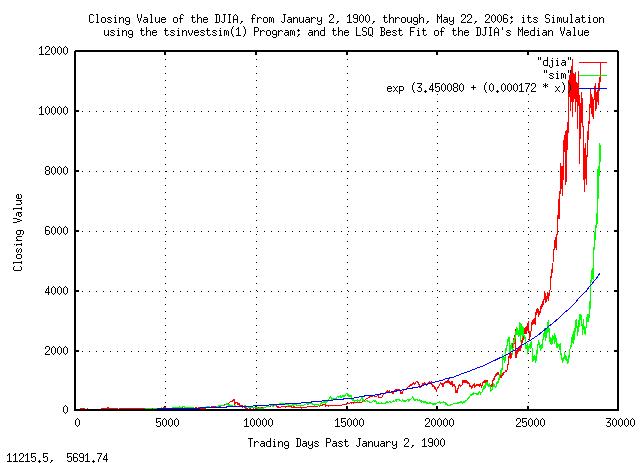

Plotting the closing values of the DJIA:

|

Figure I is a plot of the daily closes of the DJIA, from January 2,

1900, through, May 26, 2006. The simulated value is constructed from

the variables extracted from the empirical data in the

script,

below, as is the median value, and presented here for comparison.

The script

used for the programs will be walked through statement by

statement, to illustrate and validate the analytic procedure.

Starting with the first two statements, and following the outline from Section I:

tsfraction djia | tsavg -p

0.000236

tsfraction djia | tsrms -p

0.010950

From Equation

(1.24), P = 0.51077625570776255708,

meaning that there are, on average, about

51 up movements, and

49 down movements, out of one

hundred. P is the probability of an up

movement in the DJIA.

Log-normal distributions of the marginal increments of a time series-those distributions commonly found in geometric progressions-are difficult to comprehend intuitively, and it is expedient to convert the time series to its Brownian Motion, (random walk,) equivalent as outlined in Section II.

The root-mean-square, rms, of the

Brownian Motion equivalent, (the next two statements in the

script):

tsfraction djia | tsmath -s 0.000236 | tsrms -p

0.010947

tsmath -l djia | tsderivative | tsmath -s 0.000176 | tsrms -p

0.010998

which are alternative methods-the first extracts the

rms directly from the geometric

progression, and the second from its Brownian Motion equivalent. The

two answers should be nearly identical. The offset, avg

= 0.000236, is subtracted from the first, and

ln (g) = ln (1.000176) = 0.000176 from

the second. The logarithm of the rms

will be useful later, ln (0.010947) =

-4.51468983285971677053.

The number of elements in the time series, and its beginning value will be of interest, later:

wc djia

29010 29010 202761 djia

head -1 djia

68.13

The marginal gain, g of the Brownian

Motion equivalent is determined by the next two statements in the

script:

tsgain -p djia

1.000176

tsmath -l djia | tsderivative | tsavg -p

0.000176

tslsq -e -p djia

e^(3.450080 + 0.000172t) = 1.000172^(20062.070643 + t) = 2^(4.977413 + 0.000248t)

The two answers should be nearly equivalent. The third line in this

section of the script provides yet another method-it uses the

exponential Least-Squares, (LSQ,) best fit to the original time

series; it, too, should provide a nearly identical answer to the to

the other two methods, (0.000176

vs. 0.000172.) The LSQ best fit to the

data starts with a first element value of exp (3.450080)

= 31.50291244093657542517.

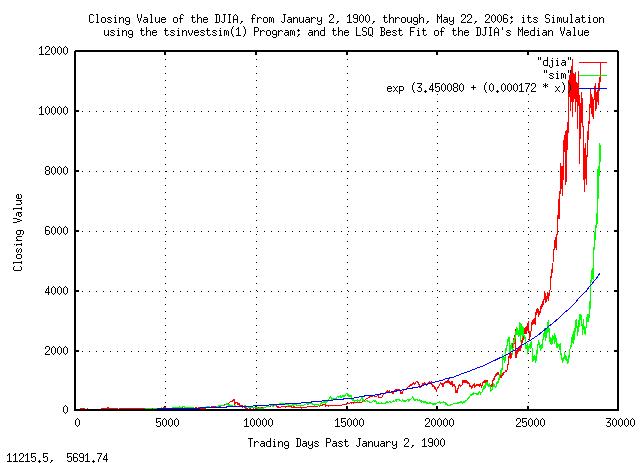

Using the variables produced by the LSQ best-fit, and plotting the Brownian Motion equivalent of the DJIA:

|

Figure II is a plot of the Brownian Motion, (random walk,)

equivalent of the DJIA, from January 2, 1900, through, May 26,

2006. The simulated values are constructed from the variables

extracted from the empirical data in the script,

below.

Having converted the DJIA's time series to its Brownian Motion equivalent, the marginal increments can be analyzed. One of issues to be addressed is leptokurtosis-specifically, the deviation from the theoretical assumption that the increments are statistically independent-this will indicate what math should be used, (if the increments are independent, then root-mean-square should be used, if not, another root-mean should be used, as per Section VI.) An iterated script will be used to find the root:

R="0.5"

#

> "log"

#

LAST="NOTHING"

#

LOOP="1"

#

while [ "${LOOP}" -eq "1" ]

do

tsmath -l djia | tsderivative | tsmath -s 0.000176 | tsintegrate | \

tsrunmagnitude -r "${R}" > "djia.magnitude"

cut -f1 "djia.magnitude" | tsmath -l > "temp.5"

cut -f2 "djia.magnitude" | tsmath -l > "temp.6"

LAST=`paste temp.5 temp.6 | egrep '^[0-5]\.' | tslsq -p`

echo "${LAST}"

R=`echo "${LAST}" | sed -e 's/^.* //' -e 's/t.*$//'`

#

if grep -e "${LAST}" "log"

then

LOOP="0"

fi

#

mv "temp.5" "temp.5.last"

mv "temp.6" "temp.6.last"

mv "djia.magnitude" "djia.magnitude.last"

echo "${LAST}" >> "log"

done

The script

fragment is an iterated search-for-solution algorithm that initially

assumes a root of 0.5, uses

tsrunmagnitude

to analyze the time series and produce a more accurate approximation

to the root, and so on, until no further improvements were

possible. (The other statements in the loop are standard Unix text

database manipulations, using

cut(1) and

paste(1) to extract, and

reassemble fields in the database,

egrep(1) to extact only days

1 - e^5.999... = 403 days, and so

forth.)

The output of the script

fragment is:

-4.592316 + 0.537435t

-4.648576 + 0.541035t

-4.653584 + 0.541347t

-4.654019 + 0.541375t

-4.654057 + 0.541377t

-4.654058 + 0.541377t

-4.654058 + 0.541377t

meaning that, at least in the very short term, (i.e., daily

returns,) there is about a 54% chance

that what happened on any one day will occur on the next day,

also.

The simulation can now be constructed using the tsinvestsim

program with the file,

djia.sim:

djia, p = 0.51077625570776255708, f = 0.010950, i = 31.50291244093657542517, h = 0.541377, l = 1

and running the tsinvestsim:

tsinvestsim djia.sim 29010 | cut -f3 > sim

And, analyzing the simulation file,

sim, in an identical manner to

the DJIA analysis:

tsfraction sim | tsavg -p

0.000253

tsfraction sim | tsrms -p

0.010994

tsmath -l sim > sim.ln

tslsq -e -p sim

e^(3.548001 + 0.000146t) = 1.000146^(24382.768809 + t) = 2^(5.118683 + 0.000210t)

Which compares favorably to the original analysis of the DJIA. The files produced in the simulation were presented in Figure I and Figure II, above, for comparison with the original DJIA time series.

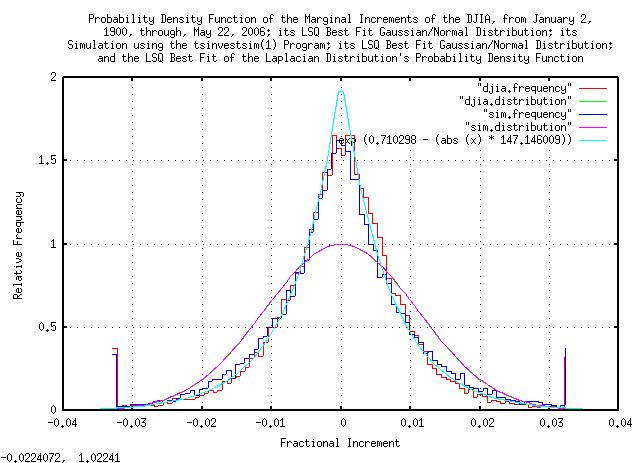

The ground work is now prepared to look into issues of leptokurtosis of the DJIA. As presented in Section VI, the model used will be Laplacian distribution:

tsfraction djia | tsmath -s 0.000236 | tsnormal -t > djia.distribution

tsfraction djia | tsmath -s 0.000236 | tsnormal -t -f > djia.frequency

tsfraction sim | tsmath -s 0.000236 | tsnormal -t > sim.distribution

tsfraction sim | tsmath -s 0.000236 | tsnormal -t -f > sim.frequency

egrep '^-' djia.frequency | wc

50 100 950

egrep '^-' djia.frequency | tail -49 | tslsq -e -p | sed 's/ = .*$//'

e^(0.710298 + 147.146009t)

Here, the offset of distribution is subtracted, as above, from the

marginal increments of the DJIA's value, and its simulation, and a

histogram of the marginal increments made with the tsnormal

program. An LSQ approximation to the distribution is necessary, and

since the Laplace distribution is a double exponential, the negative

side of the distribution is omitted using

egrep(1), and the

tslsq

program used to provide the LSQ best-fit approximation to the

distribution. And plotting:

|

Figure III is a plot of the distribution of the marginal increments of the Brownian Motion, (random walk,) equivalent of the DJIA, from January 2, 1900, through, May 26, 2006, and its simulation. The Gaussian/Normal LSQ best-fit approximation is presented as a comparison, also-the variance of all distributions shown is nearly identical, as would be expected.

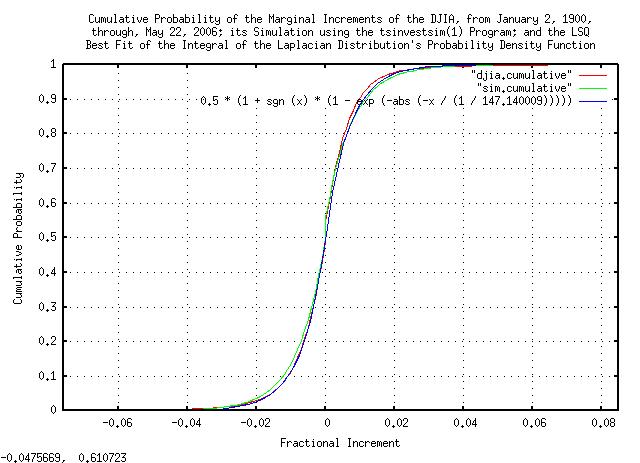

Integrating the count of marginal increments in each

0.1% "bucket" to obtain the

cumulative probabilities:

tsfraction djia | tsmath -s 0.000236 | sed 's/[0-9][0-9][0-9]$//' | sort -n | \

tscount -r | tsmath -t -d 29009 | tsintegrate -t > djia.cumulative

tsfraction sim | tsmath -s 0.000236 | sed 's/[0-9][0-9][0-9]$//' | sort -n | \

tscount -r | tsmath -t -d 29009 | tsintegrate -t > sim.cumulative

And plotting:

|

Figure IV is a plot of the cumulative distribution of the marginal increments of the Brownian Motion, (random walk,) equivalent of the DJIA, from January 2, 1900, through, May 26, 2006, and its simulation. It was analyzed by a different method-its derivative should be much the same as Figure III, above, and is included as a method of cross-checking the data and analysis.

The run lengths of the expansions and contractions of the DJIA:

tsmath -l djia | tsderivative | tsmath -s 0.000176 | tsintegrate | tsrunlength | cut -f1,7 > djia.length

tsmath -l sim | tsderivative | tsmath -s 0.000176 | tsintegrate | tsrunlength | cut -f1,7 > sim.length

And, plotting:

|

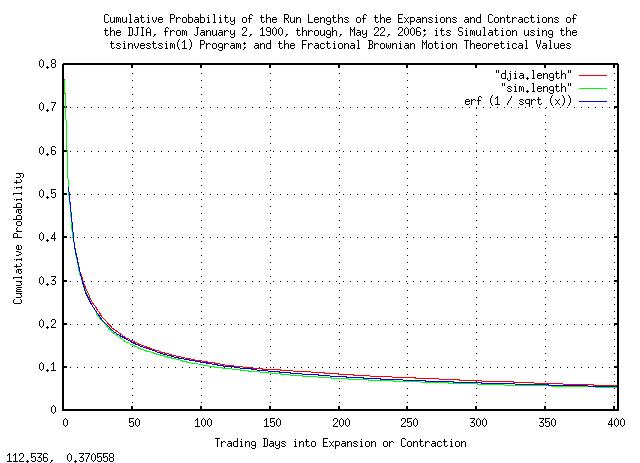

Figure V is a plot of the cumulative probability of the run lengths

of the expansions and contractions of the Brownian Motion, (random

walk,) equivalent of the DJIA, from January 2, 1900, through, May 26,

2006, and its simulation. erf (1 / sqrt

(x)) is the theoretical value. As an example

interpretation, there is a little over

10% chance of a the value of the DJIA

being above its median value for at least

100 trading days.

And, the magnitude of the expansions and contractions of the DJIA:

tsmath -l djia | tsderivative | tsmath -s 0.000176 | tsintegrate | tsrunmagnitude > djia.magnitude

tsmath -l sim | tsderivative | tsmath -s 0.000176 | tsintegrate | tsrunmagnitude > sim.magnitude

And, plotting:

|

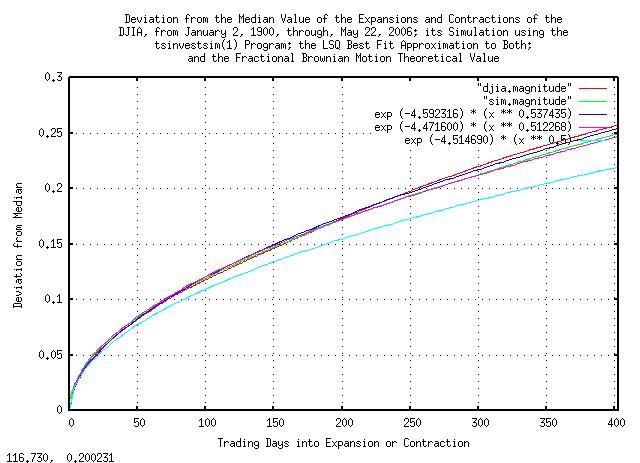

Figure VI is a plot of the deviation from the median value of the

expansions and contractions of the Brownian Motion, (random walk,)

equivalent of the DJIA, from January 2, 1900, through, May 26, 2006,

and its simulation. 0.010947 * sqrt (x)

is the theoretical value. As an example interpretation, there is a

standard deviation chance that the value of the DJIA will be within a

little more than +/- 10% of its median

value at 100 trading days.

The discrepancies of the curves from the theoretical values are do

to market inefficiencies. The empirical curves are steeper

for small time intervals, (near 1 day,) because the market does not

respond instantaneously to new information-there is a slight

persistence from one day to the next. Additionally, the

empirical curves are steeper than the theoretical at

253 trading days, (about a calendar

year,) for structural reasons-specifically, taxation

schedules that favor funds selling off losing equities before the end

of the calendar year. It should be noted that deviation from the

theoretical values is not constant, and varies throughout the calendar

year. The LSQ best fit approximations are an average over the

403 days-about

19 months.

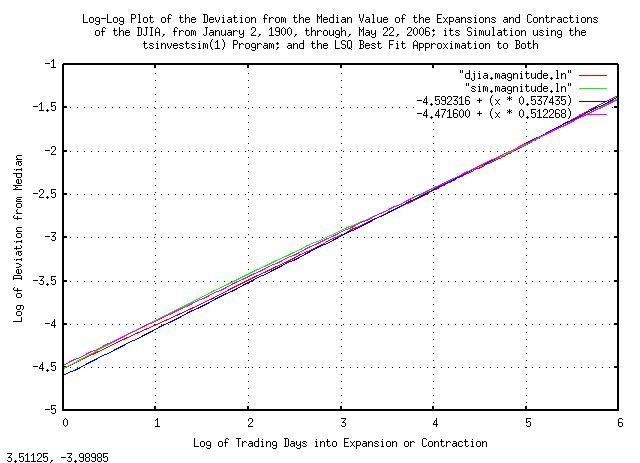

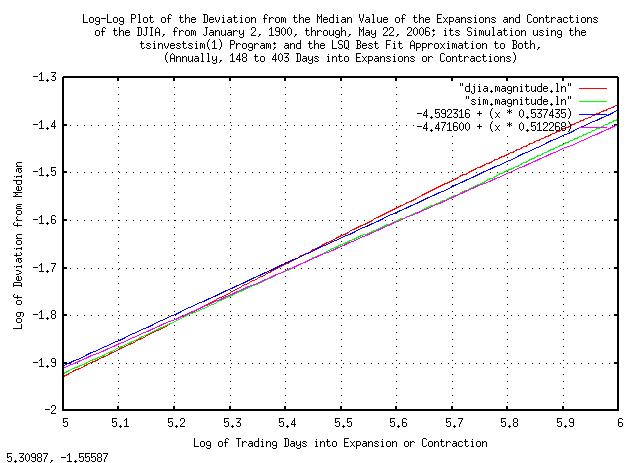

Market inefficiencies are exploitable, (if the DJIA were a perfect Brownian Motion random walk, the market would be fair, and no one could have an advantage over anyone else in the long run.) Delving into the market inefficiencies by making a log-log plot of Figure VI.

cut -f1 djia.magnitude | tsmath -l > temp.1

cut -f2 djia.magnitude | tsmath -l > temp.2

paste temp.1 temp.2 > djia.magnitude.ln

cut -f1 sim.magnitude | tsmath -l > temp.3

cut -f2 sim.magnitude | tsmath -l > temp.4

paste temp.3 temp.4 > sim.magnitude.ln

egrep '^[0-5]\.' djia.magnitude.ln | tslsq -p

-4.592316 + 0.537435t

egrep '^[0-5]\.' sim.magnitude.ln | tslsq -p

-4.471600 + 0.512268t

And, plotting:

|

Figure VII is a log-log plot of the deviation from the median value of the expansions and contractions of the Brownian Motion, (random walk,) equivalent of the DJIA, from January 2, 1900, through, May 26, 2006, and its simulation shown in Figure VI.

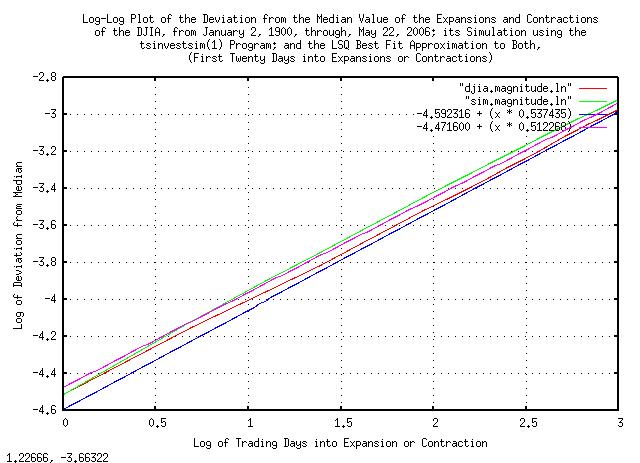

And, plotting Figure VII for short time intervals to emphasize the market inefficiency:

|

Figure VIII is a log-log plot of the deviation from the median value of the expansions and contractions of the Brownian Motion, (random walk,) equivalent of the DJIA, from January 2, 1900, through, May 26, 2006, and its simulation, plotted for a few trading days.

And, plotting Figure VII around a calendar year to emphasize the market inefficiency:

|

Figure IX is a log-log plot of the deviation from the median value of the expansions and contractions of the Brownian Motion, (random walk,) equivalent of the DJIA, from January 2, 1900, through, May 26, 2006, and its simulation, plotted at a calendar year.

Figure VIII and Figure IX indicate exploitable market inefficiencies-where the marginal increments are not statistically independent, (iid,) meaning some sense of predictability.

To remove the statistical dependence, the marginal increments of the Brownian Motion, (random walk,) equivalent of the DJIA can be moved randomly, (i.e., scrambled,) in the time series, and the random walk equivalent of the time series re-assembled, then the deviation from the median value of the expansions and contractions analyzed:

#

tsmath -l djia | tsderivative | tssequence | sort -n | cut -f3 | \

tsmath -s 0.000176 | tsintegrate > "scrambled"

#

R="0.5"

#

> "log"

#

LAST="NOTHING"

#

LOOP="1"

#

while [ "${LOOP}" -eq "1" ]

do

tsrunmagnitude -r "${R}" "scrambled" > "scrambled.magnitude"

cut -f1 "scrambled.magnitude" | tsmath -l > "temp.7"

cut -f2 "scrambled.magnitude" | tsmath -l > "temp.8"

LAST=`paste temp.7 temp.8 | egrep '^[0-5]\.' | tslsq -p`

echo "${LAST}"

R=`echo "${LAST}" | sed -e 's/^.* //' -e 's/t.*$//'`

#

if grep -e "${LAST}" "log"

then

LOOP="0"

fi

#

mv "temp.7" "temp.7.last"

mv "temp.8" "temp.8.last"

mv "scrambled.magnitude" "scrambled.magnitude.last"

echo "${LAST}" >> "log"

done

The output of the script

fragment is:

-4.498716 + 0.496851t

-4.495234 + 0.496649t

-4.495005 + 0.496635t

-4.494994 + 0.496635t

-4.494994 + 0.496635t

-4.494994 + 0.496635t

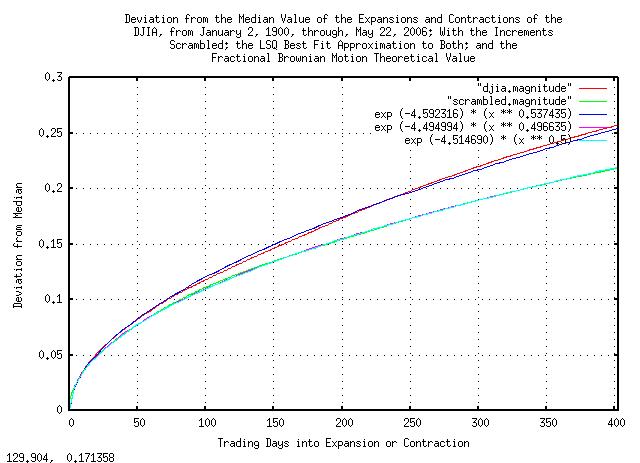

And, plotting:

|

Figure X is a plot of the deviation from the median value of the

expansions and contractions of the scrambled Brownian Motion, (random

walk,) equivalent of the DJIA, from January 2, 1900, through, May 26,

2006, and its simulation. 0.010947 * sqrt

(x) is the theoretical value. Note that comparing with

Figure

VI, the deviation is, within numerical precision, very close the

the theoretical value.

The distribution of the marginal increments of the scrambled Brownian Motion, (random walk,) equivalent of the DJIA are the same as shown in Figure III, above, since they are the same increments.

How good is the Laplacian distributed marginal increment approximation?

To get an idea, compare the PDF tail with the empirical tail using the formula for the PDF:

exp (0.710298 - (abs (x) * 147.146009))

The deviation would be:

sqrt (2) / 147.146009 = 0.009610954

There were 29015 trading days

represented in the time series for the DJIA, and 1 /

29015 = 0.000034464, so, the value

0.07466,

(7.7682 deviations, the largest expected

marginal increment in the PDF,) should be represented in the time

series about once, (e.g., exp (0.710298 - (abs (0.07466)

* 147.146009)) = 0.000034464). Any more would be excess

"fat tails," which the model did not handle appropriately. Sorting by

the value of marginal increments:

tsfraction -t "djia" | cut -f1 > "1.temp"

tsfraction -t "djia" | cut -f2 > "2.temp"

paste "2.temp" "1.temp" | sort -n > "djia.increments"

And editing for those marginal increment values greater than

0.07466:

| Value | Date |

|---|---|

-0.235228 |

19141213 |

-0.226105 |

19871019 |

-0.128207 |

19291028 |

-0.117288 |

19291029 |

-0.113283 |

19211219 |

-0.105631 |

19180920 |

-0.099154 |

19291106 |

-0.087304 |

19330526 |

-0.084035 |

19320812 |

-0.082892 |

19070314 |

-0.080394 |

19871026 |

-0.078433 |

19330721 |

-0.077550 |

19371018 |

0.079876 |

19320610 |

0.087032 |

19311008 |

0.090343 |

19330419 |

0.090758 |

19320506 |

0.091858 |

19320213 |

0.093509 |

19311218 |

0.093563 |

19291114 |

0.094708 |

19320211 |

0.095184 |

19320803 |

0.101488 |

19871021 |

0.106771 |

19330531 |

0.113646 |

19320921 |

0.118652 |

19180919 |

0.118839 |

19211217 |

0.123441 |

19291030 |

0.153418 |

19330315 |

Table I is a list of the 29 marginal

increments of the DJIA, (January 2, 1900, to, May 22, 2006,

inclusive,) that were greater than

0.07466,

(7.7682 deviations.) The

29 represent 29 / 29015 =

0.00099948 or about

0.1%, which would be expected about once

every 1000 trading days, or about once

every 4 years of

253 trading days per year.

Finding the marginal increments that were greater than

0.07466 by year:

cut -f2 "djia.increments" | sed 's/[0-9][0-9][0-9][0-9]$//' | \

sort -n | tscount | sort -n

| Number in Year | Year |

|---|---|

1 |

1907 |

1 |

1914 |

1 |

1937 |

2 |

1918 |

2 |

1921 |

2 |

1931 |

3 |

1987 |

5 |

1929 |

5 |

1933 |

7 |

1932 |

Table II is a list of the 29 marginal

increments of the DJIA, (January 2, 1900, to, May 22, 2006,

inclusive,) that were greater than

0.07466,

(7.7682 deviations,) by year in which

the excessive marginal increment occurred. Notice the extreme

clustering in the Great Depression; if it was a random process, we

would expect to see the excessive increments about once every four

years, yet 1932 had seven, and there were seventeen between 1929 and

1933, an order of magnitude and a half too many.

Hand editing for the month in which excessive marginal increments occurred:

| Number in Month | Month |

|---|---|

1 |

04 |

1 |

06 |

1 |

07 |

2 |

02 |

2 |

03 |

2 |

08 |

2 |

11 |

3 |

05 |

3 |

09 |

4 |

12 |

8 |

10 |

Table III is a list of the 29

marginal increments of the DJIA, (January 2, 1900, to, May 22, 2006,

inclusive,) that were greater than

0.07466,

(7.7682 deviations,) by month in which

the excessive marginal increment occurred. Notice the clustering in

October; if it was a random process, we would expect to see the

excessive increments about 29 / 12 =

2.417 times a month, yet October had eight-about a

factor of 3 too many, (the beginning of calendar Q4 is when fund

managers-managing about 60% of equities in the US equity markets-sell

off their losers for the year for tax purposes; so this may be a

structural issue.)

It is doubtful that an analytic function PDF with a finite

variance, (even if stable,) will model the clustered excessive

increments adequately-and addressing the issues will have to be left

to experienced judgment. It is worth noting, however, that the market

does correct itself of excessive increments; the sum of the negative

excessive increments, (13 of them,) in

the DJIA's daily close for 106 years is

-1.515504; the sum of the positive

excessive increments, (16 of them,) is

1.653086, almost totally cancelling, in

the extreme long run. (Or, as a geometric progression, the negative

excessive marginal increments was

0.195027, and the positive

4.811824, for a factor of

0.195027 * 4.811824 = 0.9384, which is

remarkable considering the DJIA increased by a factor of

11125.32 / 68.13 = 163.30 in the

106 years.) It may well be that a

survival strategy for a once-in-four years excessive marginal

increment cluster is appropriate, (but that is not easy; for example,

during the Great Depression, the DJIA was a maximum of 381.17 on

September 3, 1929, and deteriorated to a minimum for the century of

41.22 on July 8, 1932-about 3 years later-and did not recover to its

original maximum until November 23, 1954 when it hit 382.74-about a

quarter of a century later; and that is not adjusted for

inflation.)

The annual market inefficiencies would be difficult to exploit,

(they only happen once a year,) except as a defensive

strategy. However, the short term inefficiencies do offer an

opportunity. Rerunning the script

with an LSQ of only a few days:

R="0.5"

#

> "log"

#

LAST="NOTHING"

#

LOOP="1"

#

while [ "${LOOP}" -eq "1" ]

do

tsmath -l djia | tsderivative | tsmath -s 0.000176 | tsintegrate | \

tsrunmagnitude -r "${R}" > "djia.magnitude"

cut -f1 "djia.magnitude" | tsmath -l > "temp.9"

cut -f2 "djia.magnitude" | tsmath -l > "temp.10"

LAST=`paste temp.9 temp.10 | egrep '^[0]\.' | tslsq -p`

echo "${LAST}"

R=`echo "${LAST}" | sed -e 's/^.* //' -e 's/t.*$//'`

#

if grep -e "${LAST}" "log"

then

LOOP="0"

fi

#

mv "temp.9" "temp.9.last"

mv "temp.10" "temp.10.last"

mv "djia.magnitude" "djia.magnitude.last"

echo "${LAST}" >> "log"

done

The output of the script

fragment is:

-4.510133 + 0.518242t

-4.539663 + 0.521663t

-4.545016 + 0.522309t

-4.546053 + 0.522481t

-4.546241 + 0.522468t

-4.546241 + 0.522468t

-4.546241 + 0.522468t

Meaning that there is a little over a 2% chance that what happened in the DJIA on any given day will happen on the next day, also.

This analysis was originally used to design the algorithm used in

the -d5 option to the tsinvest

program. Checking:

sed 's/^/DJIA /' djia | tsnumber | tsinvest -r | tail -1

# DJIA, p = 0.510810, f = 0.010949, h = 0.544745, i = 68.130000

tsinvestsim djia.sim 29010 | tsinvest -r | tail -1

# DJIA, p = 0.511489, f = 0.010994, h = 0.548321, i = 31.787033

Numbers which agree very favorably with this analysis. And, running the program on the DJIA time series, from January 2, 1900, through, May 26, 2006:

sed 's/^/DJIA /' djia | tsnumber | tsinvest -its -d5 | egrep DJIA | cut -f3 | tsgain -p

1.000535

The theoretical gain, g, per trading

day would be, (from: Equation

(1.20)):

rms = e^(-4.546241) = 0.0106070013

P = 0.522468

g = ((1 + 0.0106070013)^0.522468) * ((1 - 0.0106070013)^(1 - 0.522468))

g = 1.0004204851

The reason the measured daily gain,

g, is larger than the

theoretical value is the sophistication of the algorithm used

in the tsinvest

program-it maintains two different tables, (one probability density

function for positive movements, another for negative,) and calculates

the probabilities of future movements using the empirically derived

probability density functions, (as opposed to the LSQ approximation of

daily returns for a year used in this analysis.) But the theoretical

and empirical values are reasonably close.

Compare these values with the gain of the DJIA, from January 2, 1900, through, May 26, 2006:

tsgain -p djia

1.000176

Which would be the long term investment potential of the DJIA, (from Equation (1.24)):

avg = 0.000236

rms = 0.010950

P = ((0.000236 / 0.010950) + 1) / 2 = 0.51077626

g = ((1 + 0.010950)^0.51077626) * ((1 - 0.010950)^(1 - 0.51077626))

g = 1.0001760701

The difference in annual gain is significant. Exploiting short term

market inefficiencies resulted in an annual gain, (of 253 trading

days,) of 1.000535^253 =

1.1449017271, or a little less than 15% per

year. Compared with 1.000176^253 =

1.0455301549, or a little less than 5% per year

as a long term investment.

There are other engineered solutions for increasing the value of investments in the DJIA equities, too-as explained in Quantitative Analysis of Non-Linear High Entropy Economic Systems V-specifically, see a simulation of the strategy, which yielded a little over a 17% annual growth in value over the last quarter of the Twentieth Century.

It is interesting to note that, in the long run, a well executed long term portfolio strategy-specfically, rebalancing expeditiously-is more important than timing the market, (which is what this analysis was about,) which, in turn, is more important than picking winners.

A well designed strategy does all three, but in that order of priority.

|

As a side bar, this is the intended usage of the

A word of caution, however. The program is a tool, and a tool is no better than the mechanic using it. It is not a substitute for due diligence and meticulous research. It would probably be better to view the program as a search mechanism for investments-like a Google of the ticker, where one searches for equities/investments that fit a search criteria, (i.e., an investment strategy.) It is a tool for extending the depth and breadth, (and speed,) of investing. |

A note about the DJIA time series:

From 1895, the inception of the DJIA, (although this analysis started with January 2, 1900,) until 1953, trading used 6 day, (actually, five and a half-but even that varied,) weeks-after 1953, 5 day weeks were used; about half of the century's data had 6/5's as many trading days per year in the time series. The number of holidays when the exchanges closed varied over the century, too.

Prior to 2001, equity values were listed in fractions of 1/8'th dollar, (i.e., from the pieces of eight tradition of the NYSE.) After 2001, values were expressed in decimal values, i.e., 1/100'th of a dollar, or a penny.

The DJIA is made up of 30 equities, and the equities are changed to represent the market environment; for example, only GE has a been a constituent part of the DJIA since its inception.

The market inefficiencies have evolved over the century due to the advent of programmed/algorithmic trading. At the beginning of the Twentieth Century, brokers could make handsome profits exploiting the spread, (i.e., arbitrage-since the markets moved at a slower pace,) but at the end of the century, the spread was so small that many brokerage firms had to seek other endeavors-like selling analysis of companies and their equities.

All of these represent anomalies effecting the accuracy of the analysis.

The time series of the DJIA contained 29010 daily closes, (29009

increments.) The margin of error, (using statistical estimation,)

would be 0.010950 / sqrt (29009) =

0.0000642906, meaning that there is a 95% probability,

(i.e., two double sided standard deviations,) that the deviation of

the increments is more than 0.010950 - 0.0000642906 =

0.0108857094, and, less than 0.010950 +

0.0000642906 = 0.011014291, which is about

+/- 0.6%. There is, also, a 95%

probability that the average of the increments is more than

0.000236 - 0.0000642906 = 0.0001717094,

and, less than 0.000236 + 0.0000642906 =

0.0003002906, which is a little more than

+/- 27%, which could be a source of

significant error in the analysis-the average of the increments can

only be known to within a factor of about 2, with a 95% confidence

level. (Note that this uncertainty can be addressed by modifying

P in Equation

(1.24) appropriately to accommodate data set size issues. This is

how the tsinvest

program avoids "chasing bubbles"; its just another

uncertainty that the program has to address).

The distribution of the increments of the Brownian Motion, (random

walk,) equivalent of the DJIA, (see Figure

III,) holds reasonably well through 3 deviations. The Laplacian

distribution used has PDF, (probablity distribution function,) of

e^(x / 0.00679597093) giving a variance

of 2 * 0.00679597093)^2, or a deviation

of 0.00961095426.

The cumulative tail counts would be, (and the actual counts, see Figure IV):

Beyond 3 deviations, there should be 208.46 negative increments and 208.46 positive increments; there were 366 negative increments counted, and 291 positive increments.

Beyond 4 deviations, there should be 50.68 negative increments and 50.68 positive increments; there were 174 negative increments counted, and 130 positive increments.

Beyond 5 deviations, there should be 12.32 negative increments and 12.32 positive increments; there were 88 negative increments counted, and 72 positive increments.

Beyond 6 deviations, there should be 2.99 negative increments and 2.99 positive increments; there were 44 negative increments counted, and 36 positive increments.

Beyond 7 deviations, there should be 0.73 negative increments and 0.73 positive increments; there were 27 negative increments counted, and 20 positive increments.

Note that there is more high order kurtosis than can be explained by the model used. (There are several conjectures: LSQ methodology was used extensively, and with the center of the distribution missing from the data-the most populous data segment-the LSQ approximation could be skewed; there are Levy stable characteristics in the distribution-but the deviation of the increments seems stable, which would be contradictory; there is white noise added to the distribution, possibly created by data collection issues-much of the Twentieth Century collection was done manually-or market overload anomalies created by matching bid/ask failures; yet another conjecture is the assumption, in the model, of a uniform distribution of interday trades.) With so few discrepant data points in the tails, it difficult to make a reliable assessment.

|

As a side bar, note that, for example, the chances of at least

a 5 deviation, (i.e., greater than a 5 sigma hit,) in the

Brownian Motion, (random walk,) equivalent of the DJIA is

0.000000286651571558 using a Gaussian/normal paradigm of the PDF

of the increments, (about 1 in 3,488,556 trading days, or about

once in 13,789 calendar years of 253 trading days per calendar

year-about the duration, so far, of civilization, itself.) The

model used predicts a much greater frequency, about

The Gaussian/normal paradigm is very inappropriate for assessing the risk frequencies of catastrophic events in financial time series-not to mention that high risk daily closes tend to cluster together, (which is what this analysis was about-they are not iid, i.e., statistically independent.) Not to mention that the clusters tend to be synchronous/causal with annual structural phenomena, too. The issue is that any mathematical abstraction should be approached carefully and used with caution-this analysis provides a mathematical model/abstraction of bubbles in financial markets, (look at the graphs, above-that is what they are all about,) which is relatively good. But that does not mean caution is inappropriate. |

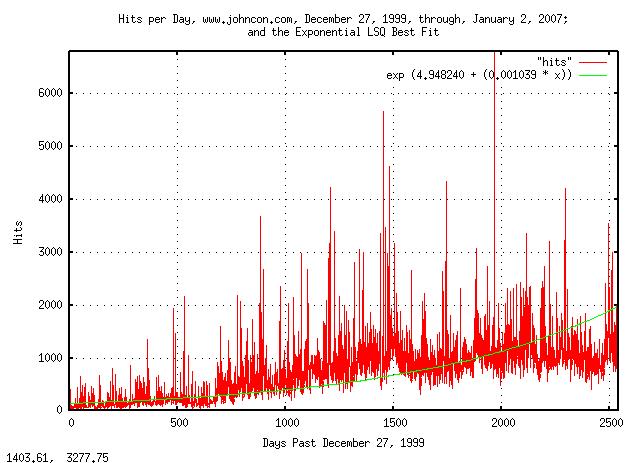

To illustrate the ubiquity of time series with geometric progressions, Laplacian distributed increments, and, log-normal evolution, web server page hits will be analyzed-this domain, www.johncon.com, will provide the example. It is not intuitively obvious that server page hits would have these characteristics until it is considered:

For hits to increase over time, the site must be known-and to be known, it has to be bookmarked, (or found by a search engine, or introduced in a mailing list, etc.,) which would lead to more bookmarks, and so on. The probability of a bookmark leading to yet another book mark would remain much the same over time, and if the average probability is greater than unity, the number of hits per day will follow an increasing geometric progression; but there will be significant random variation from day to day, leading to a log-normal evolution over time.

The probability of a hit during any time interval during the day would be approximately constant, leading to Laplacian distributed increments in the time series of web server hits per day.

Finding the median value of page hits per day:

tslsq -e -p "hits"

e^(4.948240 + 0.001039t) = 1.001040^(4761.533341 + t) = 2^(7.138801 + 0.001499t

And plotting:

|

Figure XI is a plot of the web server hits per day for domain www.johncon.com, from December 27, 1999, through, January 2, 2007, and its median value, determined by exponential LSQ best fit. (The hits were filtered to exclude crawlers and information robots.)

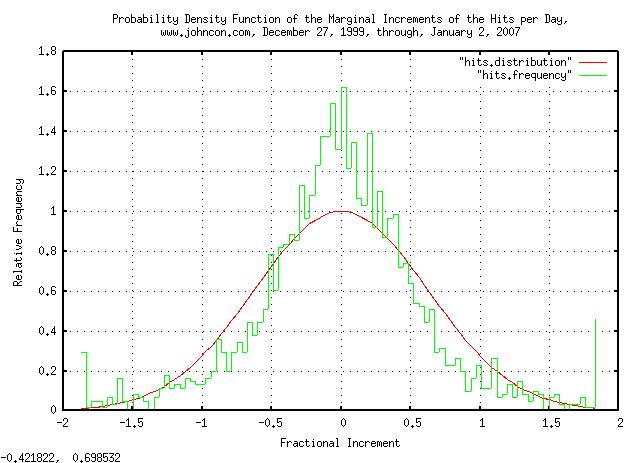

And, analyzing the increments of the server hits:

tsmath -l "hits" | tslsq -o | tsderivative | tsnormal -t > "hits.distribution"

tsmath -l "hits" | tslsq -o | tsderivative | tsnormal -f -t > "hits.frequency"

And plotting:

|

Figure XII is a plot of the distribution of the marginal increments of the Brownian Motion, (random walk,) equivalent of the web server hits per day for domain www.johncon.com, from December 27, 1999, through, January 2, 2007, which should be compared with Figure III, above.

Note the implications of the analysis:

The page hits of the web server sites on the Internet will evolve into a log-normal distribution.

The duration of time (i.e., the median time,) that a site is

the most popular, as measured by the number of hits per day, will be

erf (1 / sqrt (t)), or a little over 4

years, (using years as the time scale.)

The ratio of the number of hits per day of the most popular

site to the median of all sites will diverge as e^sqrt

(t) over time.

The growth in the number of page hits per day will grow exponentially, (although the exponential rate will vary, randomly-even decreasing at times.)

Black Scholes Merton methodology can be used to estimate the severity of a downturn in the markets. The methodology assumes the paradigm that equity prices are a random walk fractal, i.e., starting at any specific time, a Gaussian/Normally distributed random number, (with a standard deviation of about 1% = 0.01, of the current price,) is added to the current price of the equity to get the next day's price, and then a second random number is added to get the third day's price, and so on. (Note that the market's value, over time, is a sum of Gaussian/Normally distributed random numbers under this paradigm.)

For details, see: Section I, Section II, Section III, Section IV, Section V,Section VI and Addendum of this series.

Under this paradigm, the equity's price will have a standard

deviation, at some time t in the future,

of 0.01 * sqrt (t). What this means for,

say, t = 100 days is that the equity's

price will be within one standard deviation, (0.01 *

sqrt (100) = 100% = +/- 50%,) 68% of the time. This is

the statistical metric of the magnitude of an equity's price

bubble, (be it gain, or loss, in value.)

Further, under this paradigm, the chances of the duration of an

equity's price being above, (or below,) its value at a specific time

for at least t many days in the future

is erf (1 / sqrt (t)), which is about

1 / sqrt (t) for t

>> 1. What this means is that for, say, for at

least t = 100 days in the future, the

chances of an equity's price being above, (or below,) its starting

price will be 1 / sqrt (100) = 0.1 =

10%. This is a statistical metric of the duration of

an equity's price bubble, (be it gain, or loss, in

value.)

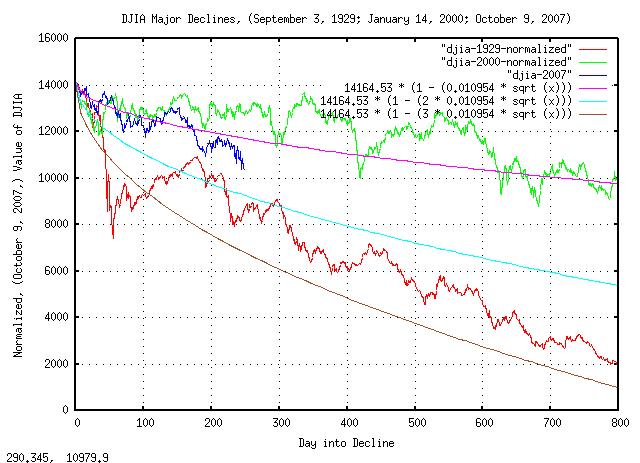

Using the daily closes of the DJIA, (from Yahoo! Finance, ticker ^DJI,) and cutting out the three major declines of the DJIA in the last century, (starting on September 3, 1929; January 14, 2000; October 9, 2007,) and normalizing to the DJIA's value on October 9, 2007, (i.e., all start at 14,164.53,) to compare the declines:

|

Figure XIII is a plot of the DJIA major declines, September 3, 1929; January 14, 2000; October 9, 2007, and, the one, two, and, three standard deviations in the magnitude of the DJIA's contractions, which was found from:

tsfraction djia | tsavg -p

0.000230

tsfraction djia | tsrms -p

0.010954

Note that the September 3, 1929, decline, (i.e., during the Great Depression,) was about a 2.5 sigma event, (which is about a 1 in 161 chance in any 800 day period.) The January 14, 2000, decline, (i.e., the dot com bubble crash,) was about a 0.625 sigma event, (which has about a 1 in 3.75 chance in any 800 day period.) Extrapolating, it looks like the current financial crisis, (October 8, 2007,) is about a 1.25 sigma event, (which is about a 1 in 9.46 chance in any 800 day period, if it continues.) It would appear, that if the crisis continues, it will be about twice as bad as the January 14, 2000, decline, and about half as bad as the September 3, 1929 decline.

There is a 50% chance, (0.5 = erf (1 / sqrt

(4.4),) that the current crisis, (October 8, 2007,)

will continue at least 4.4 years from October 8, 2007. The chances of

it lasting at least a decade, (32% = 0.32 = 1 / sqrt

(10),) and so on.

So, how bad was the Great Depression?

On September 3, 1929, the DJIA's value was 381.17, the highest until November 23, 1954, when it was 382.74.

On July 8, 1932, the DJIA's value had deteriorated to 41.22, a loss of 89% in value.

During the interval of the decline, (September 3, 1929, to, July 8, 1932,) asset, (including housing,) deflation was about 60%.

During the interval of the decline, the US GDP declined about 40%

In 1932, about 1 in 4 was unemployed

Note that the equity markets, asset values, US GDP, etc., all tend

to track, (but at different rates,) so an assessment can be made,

assuming the current crisis continues, and it will be about half as

bad as the Great Depression. The chances of the current crisis lasting

half as long as the Great Depression, ((1954 - 1929) / 2

= 12.5,) is 1 / sqrt (12.5) = 0.28 =

28% which is about 1 chance in 4, (and a 1 chance in 2

of it lasting 4.4 years.)

|

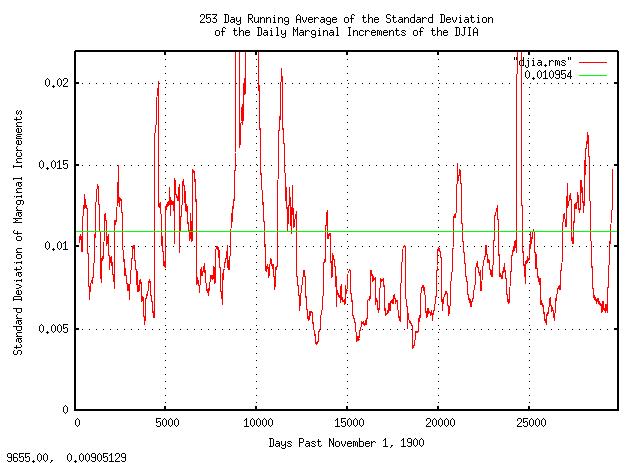

Figure XIV is a plot of the 253 day running average of the standard deviation of the daily marginal increments of the DJIA, from November 1, 1900, to October 3, 2008. Note that it was abnormally large in every decline of the DJIA. Observe how the standard deviation of the daily marginal increments effect the following equations:

avg

--- + 1

rms

P = ------- ........................................(1.24)

2

P (1 - P)

g = (1 + rms) (1 - rms) ....................(1.20)

Where avg is the arithmetic average

of the marginal increments of an equity market's value,

rms is the standard deviation of the

marginal increments, P is the

probability of an up movement in the marginal increments, (i.e., the

chances a marginal increment will be greater than unity,) and,

g is the average gain of the marginal

increments. (See: Important

Formulas for specifics, and, Section

I of this series for the derivation of the equations.)

Note that rms effects

P, which is the exponent in

g, (avg

varies, too-in the opposite direction of

rms, but it is not as dramatic.) In

point of fact, if rms is double its long

term value, g will be in decline, (i.e.,

be less than unity.) This is the mechanism of market declines, (and

many professional traders use it as a forecasting method for potential

declines and bottoms.) For example, the second largest calendar year

gain in the DJIA was 1933, (69.2697%-right in the middle of the Great

Depression-the largest was 1915, 80.8713%.) Note, also, that the

erf (1 / sqrt (t)) probability of a

bubble's duration means that there is a 50/50 chance of the

duration being longer than 4.4 years, etc., (for example, on July 17,

1990, with a value of 2999.76, the DJIA deteriorated to 2365.10 on

October 11, 1990-in 62 trading days following a three sigma

decline-then recovered in the next 160 trading days, on May 30, 1991.)

So, rms is the mechanism of market

gains, too. (The rms can be too

small-there is an optimal value, in relation to the

avg, see: Section

I.)

In this context, the statement "the current 2008 crisis is a 1.25 sigma event, (i.e., about twice as bad as the 2000 market decline, and, half as bad as the Great Depression, for perspective,) and there is a 50/50 chance that it will be over before 4.4 years from October, 2007, and a 1 in 4 chance that it will last at least 12.5 years," makes reasonable sense.

Note, also, rms is a metric of risk,

and represents the volatility of the equity market, (its also called a

metric of greed by pundits, too.) It is, also, inversely

proportional to confidence in the market, and is the engine

of market bubbles, (in gain, or loss.)

A note about this section. In an effort to keep things simple, traditional Black Scholes Merton methodology was used, which is adequate for short term projections. However, Section III of this series offers a similar, (it uses the same principles,) methodology that is substantially more accurate, in the long term.

The prevailing wisdom is that economic systems are mathematically deterministic and the concepts of classical physics can be used for analysis-such as regression and correlation studies.

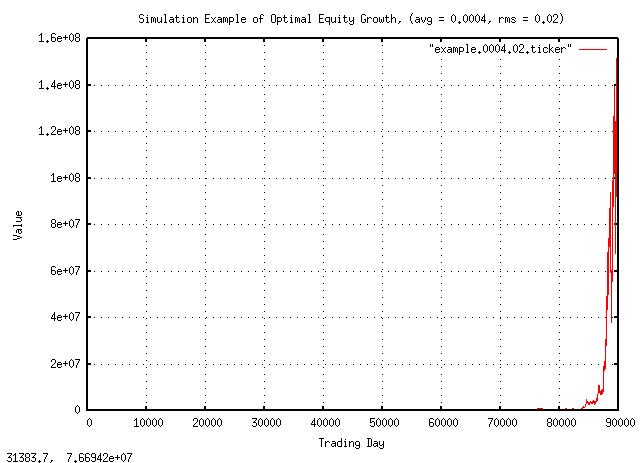

A short disproof by contradiction is in order. By building a very

precise simulation of the characteristics of a non-linear dynamical

high entropy economic system with an average of the marginal

increments, avg = 0.0004, and standard

deviation of the marginal increments of rms =

0.02, meaning the system will have an average increase

of 0.04% per day, but it will fluctuate, (with a Gaussian/normal

distribution,) of 2% per day, i.e., the fluctuations will be between

+/- 2% per day, 68% of the time. These numbers are optimal,

(rms^2 = avg,) in the sense that the

growth is maximum, (increasing, or, decreasing, avg, or increasing,

or, decreasing rms, results in lower growth,) and represent the median

values of all equities on all exchanges in the US markets in the 20'th

Century, (about a hundred thousand of them,) most of the developed

countries GDPs, precious metal prices, currency values and exchange

rates, commodity prices, and, asset prices, (like housing,) etc. The

simulation will be provided by the tsinvestsim

program from the NtropiX site.

Calculating P, the probability of an

up movement on any given day:

avg

--- + 1

rms

P = ------- ........................................(1.24)

2

P = 0.51

The control file for the tsinvestsim

program, example.0004.02:

example f = 0.02, p = 0.51

And simulating:

tsinvestsim example.0004.02 90000 | cut -f3 > example.0004.02.ticker

And analyzing:

tsfraction example.0004.02.ticker | tsavg -p

0.000402

tsfraction example.0004.02.ticker | tsrms -p

0.019936

Which are within a percent of what they should be. And, plotting:

|

Figure XV is a plot of the optimal equity growth simulation. The growth is about a factor of 1.0002 per day, which is about 5% per year, (the simulation is for 90,000 days-about 356 years-to provide a large data set for numerical accuracy.) Note that there are 51 up movements every hundred days, on average, and the average increase per day, 0.0004, is greater than zero; these two number provide the growth in value.

But is it always true?

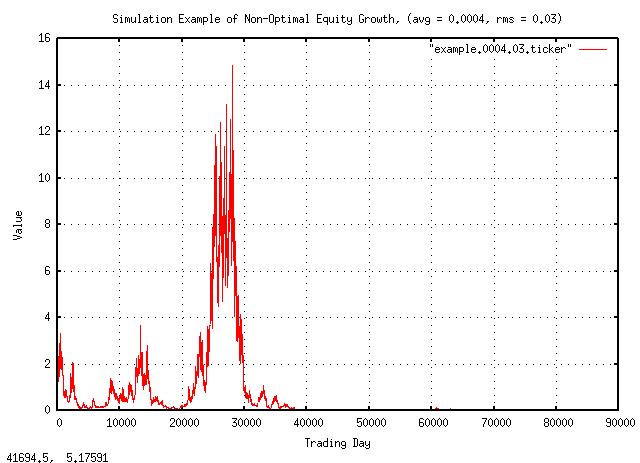

Changing the metric of risk, rms =

0.03 by 1%, (an increase of 50%,) and calculating

P, the probability of an up movement on

any given day:

avg

--- + 1

rms

P = ------- ........................................(1.24)

2

P = 0.506666666

The control file for the tsinvestsim

program, example.0004.03:

example f = 0.03, p = 0.506666666

And simulating:

tsinvestsim example.0004.03 90000 | cut -f3 > example.0004.03.ticker

And analyzing:

tsfraction example.0004.02.ticker | tsavg -p

0.000404

tsfraction example.0004.02.ticker | tsrms -p

0.029921

Which are, again, within a percent of what they should be. Note there are still more up movements every hundred days, (50.7-about 3 per 510 less than before, but still more,) on average, and the average increase per day, 0.0004, is what it was before, (and is greater than zero.)

And plotting:

|

Figure XVI is a plot of the non-optimal equity growth simulation. The growth is negative; after building to a value of 15, the equity goes bust about half way through the simulation. Compare with the previous simulation when at 356 years, the equity was worth about $140 million!

It is, indeed, counter intuitive that a stock that moves up more times than it goes down, and has a positive average gain, can deteriorate in value to nothing.

Here is what happened, in detail.

The first simulation, (optimal equity value growth):

P (1 - P)

g = (1 + rms) (1 - rms) ....................(1.20)

0.51 (1 - 0.51)

g = (1 + 0.02) (1 - 0.02)

0.51 0.49

g = 1.02 0.98

g = 1.0101505 * 1.009750517

g = 1.0002

Which is positive growth. And, for the second simulation, (non-optimal equity value growth):

P (1 - P)

g = (1 + rms) (1 - rms) ....................(1.20)

0.506666666 (1 - 0.506666666)

g = (1 + 0.03) (1 - 0.03)

0.506666666 0.493333334

g = 1.03 0.97

g = 1.01508917 * 0.9850858

g = 0.99995

Which is negative growth.

The intuitive interpretation of the regression analysis was misleading.

Things that fluctuate up more than they fluctuate down, and have a positive average daily gain, do not always increase in value; and the numbers in both simulations are very representative of real world economic phenomena like GDP, equity growth, precious metal values, housing prices, commodity prices, inflation, etc.

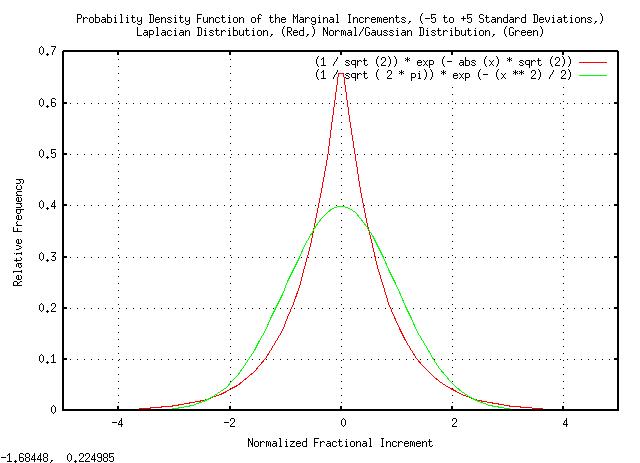

The Laplacian Probability Distribution of the marginal increments is ubiquitous in financial time series, (for example, the DJIA, Figure III, above.) The distribution is most pronounced in high speed time series, (day trading, and shorter,) and the deviation of the marginal increments is projected, (via the Central Limit Theorem,) to estimate the Normal/Gaussian probability distribution of the value of an equity, (or other financial instrument,) at some future date-which is quite accurate in the long run.

However, in the short run, the methodology can lead to very optimistic risk assessments.

|

Figure XVII is a plot of the Laplacian and the Normal/Gaussian probability distributions, both normalized to unity standard deviation, from -5 standard deviations to +5 standard deviations.

Note there are substantially more small increments in the Laplacian than the Normal/Gaussian distribution below one standard deviation. And, there are more large increments in the Normal/Gaussian than the Laplacian distribution between one and two standard deviations.

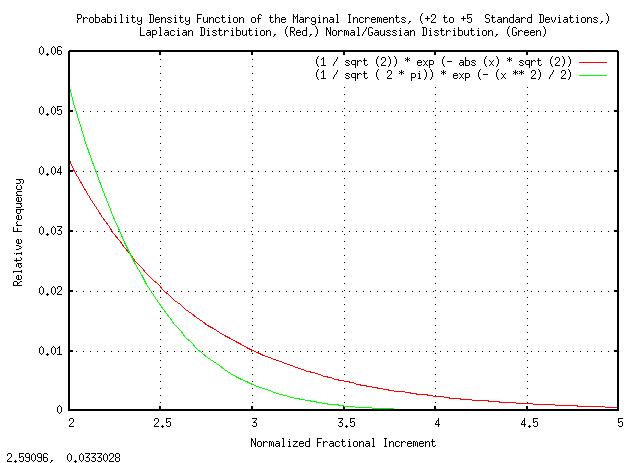

Expanding the plot for better visibility above 2 standard deviations:

|

Figure XVIII is a plot of the Laplacian and the Normal/Gaussian probability distributions, both normalized to unity standard deviation, from +2 standard deviations to +5 standard deviations.

Note that the frequency of 3 standard deviation increments in the Laplacian is about twice that of the Normal/Gaussian probability distribution-a very substantial error in risk estimation when the value of the risk should be known to better than 1% accuracy.

|

As a side bar, Black Swans do exist in financial time series. What's the frequency of seven standard deviation movements in the daily increments of financial time series using a Normal/Gaussian probability distribution? About once every three billion years. And, the frequency of seven standard deviation movements for the Laplacian probability distribution? More than once a century. Interestingly, the cumulative distribution function of the Laplacian probability distribution is in very reasonable agreement with the number and magnitude of large increment Black Swan movements in the DJIA, Figure III, analyzed, above. The point is that, although the Normal/Gaussian probability distribution/Central Limit Theorem can be a very accurate methodology for estimating the distribution of asset values in the long term, one has to survive the short term Black Swan incremental movements first-and the risks are actually much higher than predicted by the Normal/Gaussian distributed short term increments assumption. |

-- John Conover, john@email.johncon.com, http://www.johncon.com/